Prevailing Wage, or Davis-Bacon laws, prevent contractors from undermining the wages and benefits of local workers and ensures that workers on publicly funded projects are paid at least the same wages as other workers in the area. This prevents employers with the lowest bid from bringing in low paid, low skilled workers from out-of-state. Prevailing Wage keeps local tax dollars working in the community through the hiring of highly trained and skilled local workers.

Key Points

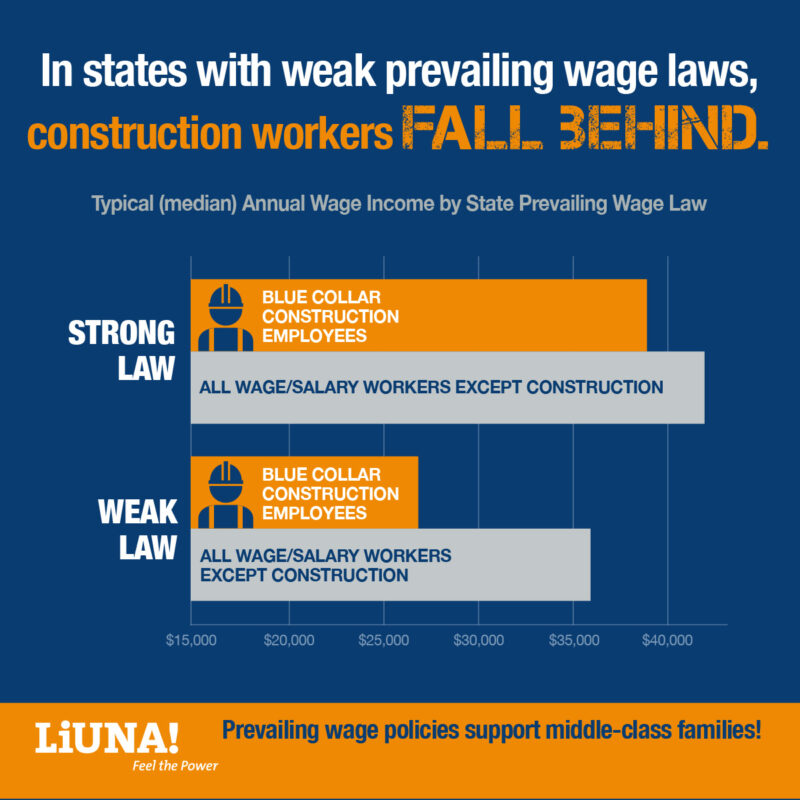

- Prevailing Wage laws prevent contractors from undermining the wages and benefits of local families.

- Prevailing Wage bolsters local economies by increasing tax revenues and local purchasing.

- Prevailing Wage supports in-state contractors and builds local middle-class jobs while driving economic development.

- Prevailing Wage creates an incentive to make contractors more efficient and productive.

Repealing Davis-Bacon/Prevailing Wage laws ...

Details

The Davis–Bacon Act (1931) is a United States Federal law that establishes the requirement for paying the local prevailing wages on public works projects for construction workers. “Local” is considered the county in which the work is performed (so, the prevailing rate in a rural county is different from the rate in an urban county). It applies to “contractors and subcontractors performing on federally funded or assisted contracts in excess of $2,000 for the construction, alteration, or repair (including painting and decorating) of public buildings or public works.”

Federal Davis-Bacon law sets a wage floor for federal construction projects that prevents government spending from undermining local wages and living standards. Twenty-seven states also have “Little Davis Bacon Acts,” or state prevailing wage laws that apply to local government and state-funded construction projects.

Prevailing wage laws ensure that all contractors bidding on public construction projects will pay family-supporting wages, and that these projects will be built to the highest standards by skilled, safe, well-trained construction craftspeople. The projects built under the Davis-Bacon Act have stood the test of time while enabling generations of craftspeople to build better, stronger lives for themselves and their families.

The Davis-Bacon Act applies to all states, even if they don’t have prevailing wage laws for state-funded projects, and applies to almost all projects funded with Federal dollars.

However, contrary voices are becoming louder, and have a receptive audience in the current administration. Corporate interests and their (often) anti-Union advocates claim that Prevailing Wage/Davis-Bacon increases taxpayer costs, even though numerous studies have shown it does not. In fact, most of the work performed under Federal Davis-Bacon rules and State Prevailing Wage laws is more productive and of higher quality than those that are not. The truth is, many employers who oppose prevailing wages do so because they want to cut workers’ paychecks and pocket the pay-cuts as profits.

As LIUNA General President Brent Booker has said, in the history of our Union, nothing has been handed to us – “It’s up to us to continue the fight.” And fight we must. We won’t stand by and let the current administration and shady business people take our hard-earned wages and benefits, and we need you to do your part. This is about your paycheck, your benefits, your safety, and your community.

What can you do? First, spread the word – talk about this with your co-workers, your family, your neighbors, your friends. Let them know what is at stake, and raise awareness. We choose to believe there is still power in numbers and power belongs to the people.

Second, reach out to your elected representatives, and don’t give up. You can send letters to both your senator and your representatives – those links will automate the process for you. Also, you can call them often, and be a good nuisance. We elected them and we pay their wages, so it’s time they fight, and vote, for our wages. Calling can be frustrating, but don’t give up, and don’t be intimidated. Make their phones ring off the hook.

Finally, stay informed. Keep these conversations going at the Union Hall and keep asking questions and educating yourself. Here are some resources to help:

- Wage surveys: The U.S. Department of Labor (DOL) is responsible for conducting wage surveys and determining the local prevailing wages. DOL collects project wage data and then determines the prevailing rates for each construction classification in each county and publishes the rates at http://www.dol.gov/. LIUNA participates in wage surveys to protect the livelihoods of LIUNA members. Find out more in LIUNA’s Field Guide to Davis-Bacon Prevailing Wage Surveys or check the prevailing wage determinations for your area.

- LIUNA Defend the Prevailing Wage Toolkit

- LIUNA Davis Bacon Act and Prevailing Wage Laws Fact Sheet

- LIUNA Field Guide to Davis-Bacon Prevailing Wage Surveys

- NAFC Prevailing Wage Studies and Reports